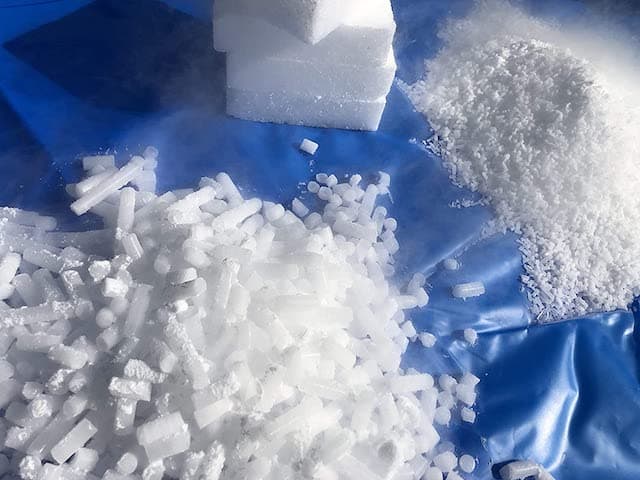

Does Walmart Sell Dry Ice? Where in Walmart Would You Find Dry Ice?

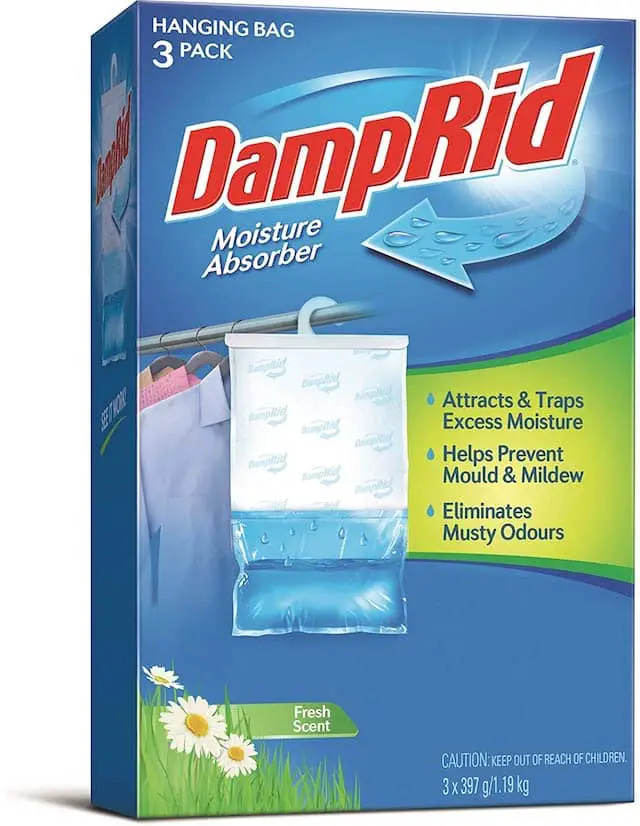

Walmart, one of the largest retail chains in the world, offers a wide range of products to its customers. Many …

Read moreDoes Walmart Sell Dry Ice? Where in Walmart Would You Find Dry Ice?